cares act stimulus check tax implications

American Rescue Plan How To Get These 1 400 Payments Marca Single filers who make more than. Taxpayers are required to.

4 Things To Know About Stimulus Checks In 2022 And Beyond Fortune

Here we outline 5 major tax implications that have stemmed from the new stimulus package.

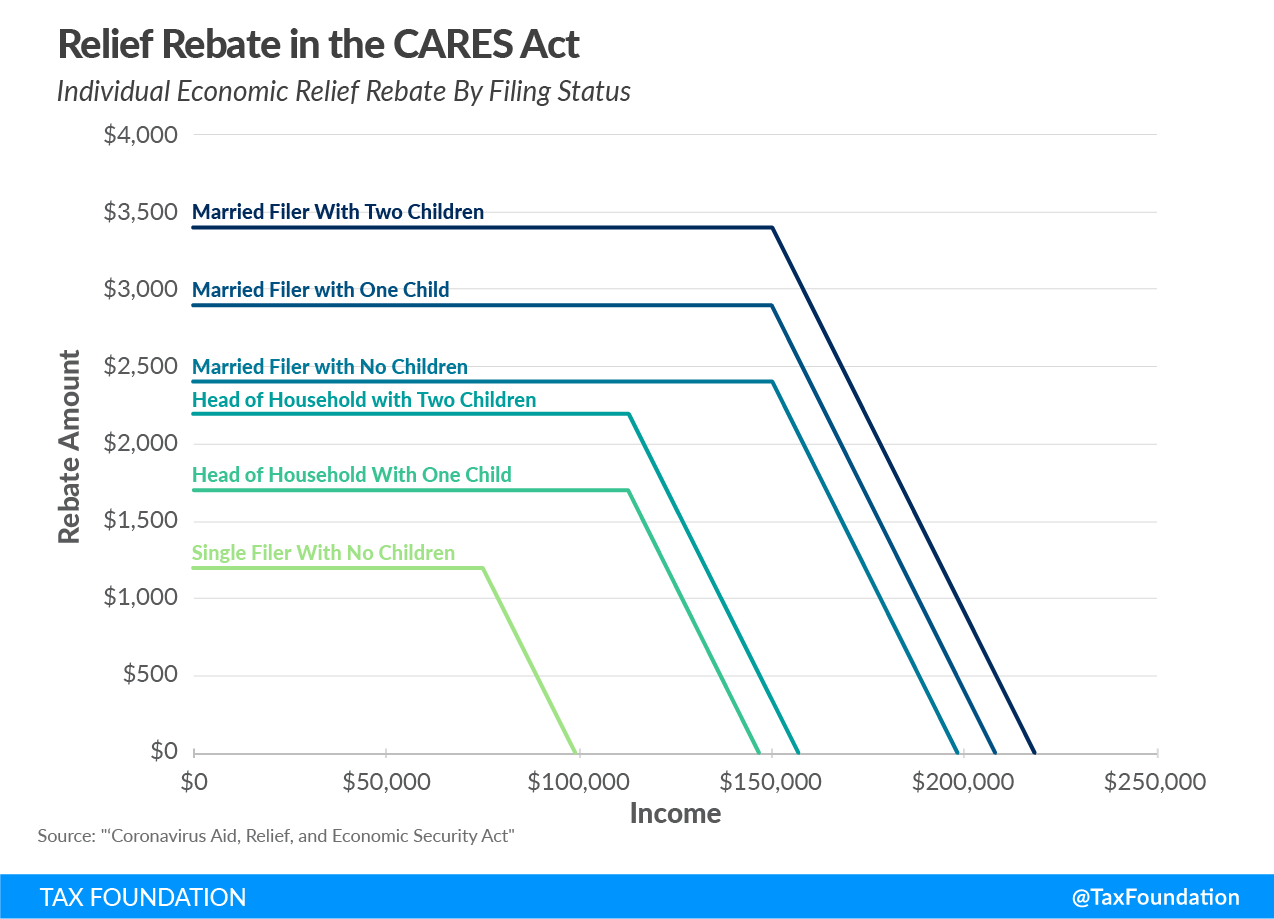

. Because the emergency financial aid grant is not included in your income you cannot claim any deduction or credit for expenses paid with the grant including the tuition. As a result of the CARES Act which became law on March 27 2020 most Americans will receive stimulus checks. The amount of the stimulus check will be reduced or phased out for individuals whose income is between 75000 and 99000 with no checks issued for those making above the 99000 threshold.

Now that its tax time business owners who took advantage of these programs will want to know how the CARES Act relief affects their taxes. The stimulus check details are as follows. Married taxpayers will get.

It reduces your income which reduces the amount of tax you owe. If you were in the 12 percent tax bracket youd reduce. Individual taxpayers will be receiving a 1200 paymentCouples will receive 2400If you have a qualifying child 16 and under each child.

CARES Act State Tax Implications POSTED 08252020 The Coronavirus Aid Relief and Economic Security CARES Act enacted March 27 2020 was designed to assist. Single taxpayers will get 1200. Economic impact payments also referred to as stimulus checks are not taxable for federal purposes but they do reduce your recovery rebate credit.

Their implications are important in any number of ways. Once taxpayers reach an adjusted gross income threshold of 75000. Numerous tax benefits are offered under the CARES Act but the implications of these tax provisions remain to be seen.

WARN Act and its Implications for. For individuals who itemize their tax returns lawmakers. Eligible taxpayers who filed tax returns for either 2019 or 2018 will automatically receive an economic impact payment of up to 1200 for individuals or 2400 for married couples.

If you had 50000 in income and had a 5000 tax deduction your deduction would reduce your taxable income by 5000. Cares act stimulus check tax implications Friday March 18 2022 Edit. Summary of the 2020 Recovery Rebates in the CARES Act PL.

If you had 50000 in income and had a 5000 tax deduction your deduction would reduce your taxable. If you have a qualifying child 16 and under each child will add an additional 500. But evaluating these tax impacts.

In this topic we look to identify the open questions surrounding. The first round of stimulus measures announced on March 12 amounted to A176 billion and included a one-off stimulus payment to welfare recipients accelerated depreciation. Couples will receive 2400.

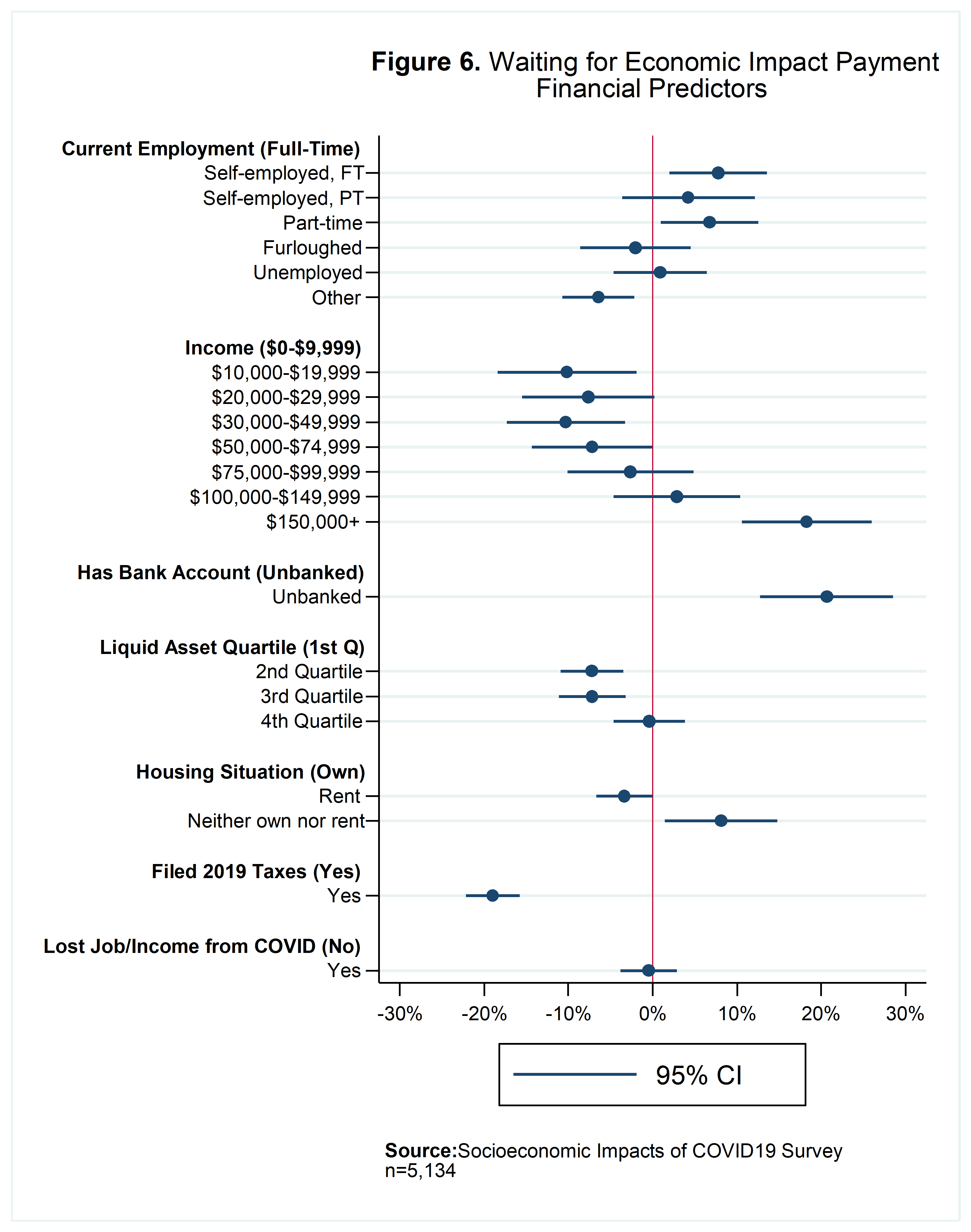

Did Cares Act Benefits Reach Vulnerable Americans Evidence From A National Survey

Lessons Learned From Economic Impact Payments During Covid 19

Where S My Third Stimulus Check Turbotax Tax Tips Videos

Did Adding Trump S Name Slow Down The Mailing Of Stimulus Checks Of Course It Did Tax Policy Center

Irs Is Trying To Catch Stimulus Payment Fraud But Billions May Have Been Paid Accounting Today

Deadline Nearing To Claim Stimulus Street Sense Media

Federal Coronavirus Relief Cares Act Faq Tax Foundation

Economic Impact Payments How Low And No Income Veterans Can Receive Theirs Now Va Homeless Programs

Short Run Economic Effects Of The Cares Act Penn Wharton Budget Model

Who Cares Assessing The Impact Of The Cares Act Frank Hawkins Kenan Institute Of Private Enterprise

Second Stimulus Package See What S In It Cnn Politics

Economic Income Payments For Immigrants Are You Eligible For A Stimulus Check Under The Cares Act Immigration And Firm News

Your 1 200 Stimulus Check How To Claim It Before It S Too Late Bankrate

Nonresident Guide To Cares Act Stimulus Checks

Did Cares Act Benefits Reach Vulnerable Americans Evidence From A National Survey

Why Haven T I Got My 1200 Stimulus Check From The Government Yet

Stimulus Checks And Child Support King Law

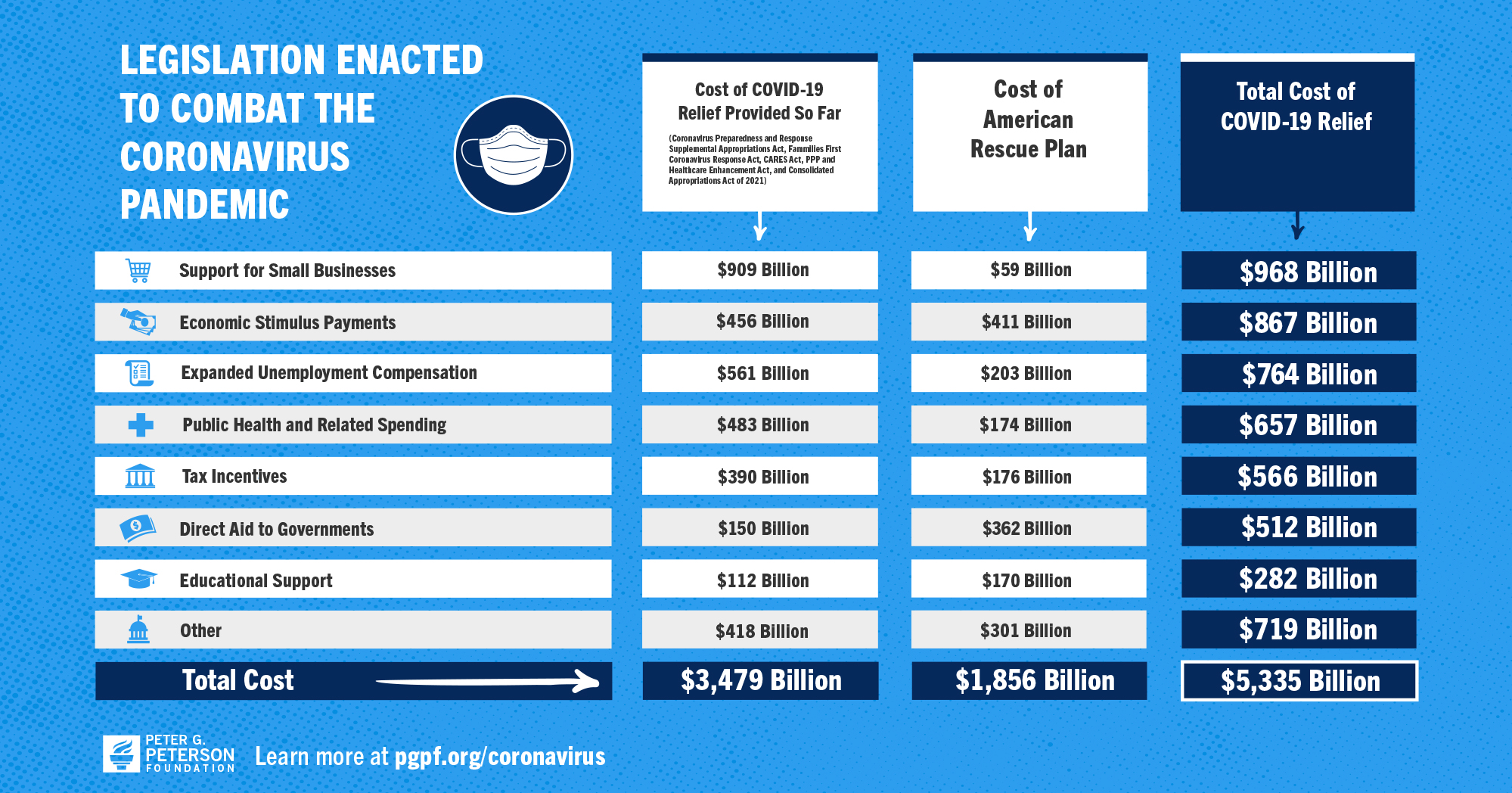

Here S Everything The Federal Government Has Done To Respond To The Coronavirus So Far

:max_bytes(150000):strip_icc()/stimulus-checks-3305750_final-1efcee858f8c410aadb15f0bc815770d-a955c2e171b54dcaa2dbb477a870b3cc.jpg)